21

2024-02

Can Hong Kong become a space hub? Possibly, experts say, but clock is ticking

Hong Kong is racing to transform itself into a smart city where technology is used to improve urban services and the living environment – but flying under the radar is the “NewSpace” industry and one front runner is already making waves.

The city’s first satellite manufacturer, Uspace Technology Group, said it expected that half of the 200 units it produces annually will go to the Greater Bay Area, to spur digital transformation and make cities in the region greener and smarter. It expects its first Hong Kong satellite to be produced this year at the earliest.

NewSpace is an emerging industry that includes private companies involved in satellite manufacturing, launch services, space law, tourism and other commercial ventures concentrated on low Earth orbit at an altitude of 2,000km (1,240 miles) or less.

While Uspace might be a leading company, aerospace specialists argue it is after a small piece of the action. They argue that Hong Kong can only take a giant step in the NewSpace business when the government offers a holistic development plan for the industry. Without proper policies in place, the city risks missing out on opportunities.

Existing industries with potential in the sector also have no idea how they fit into the bigger picture, they added.

The global space economy is estimated to be worth more than US$460 billion, with the potential to exceed US$1 trillion in the next decade or two.

Uspace said a constellation of more than 100 satellites over the bay area would allow for a wide variety of services, ranging from traffic and weather surveillance to providing data to the transport, energy, agriculture and environmental protection industries.

Lee George Lam, co-chairman of the group, told the Post in an interview that the bay area was the largest and most promising cluster of high-value smart cities and ideal for satellite data application.

Lee George Lam, co-chairman of the Uspace Technology Group, says a satellite hub the company was planning in the Middle East will create opportunities for bay area firms. Photo: Jonathan Wong

The bay area, covering Hong Kong, Macau and nine cities in Guangdong province with a population of more than 86 million, is a national development plan to turn the region into an economic powerhouse.

Lam also said a satellite hub the company was planning in the Middle East would also create business opportunities for bay area firms eyeing the multibillion-dollar NewSpace industry.

‘Happy problem’

Formerly known as the Hong Kong Aerospace Technology Group, Uspace was set up in 2019 and is among a handful of start-ups in the city focusing on the aerospace industry.

Lam said the company was on track to produce and launch the first satellite made at its new plant in Tseung Kwan O Industrial Park by the end of this year.

“We are inclined to leave a huge proportion of our annual capacity to the bay area, perhaps half for the bay area and the other half for our international clients,” said Lam, who is also an adviser of the city’s chief executive’s policy unit.

While many parties had expressed interest, Lam said, the company faced the “happy problem” of choosing the right client to be their first.

“We need to choose carefully. We want to have an impact, we don’t just want to make money. We want to assist with problem-solving, for example, in climate change,” he said.

Lam said that on top of expanding operations in Hong Kong, the company was also looking to the Middle East for investment opportunities as governments there prioritised green energy transition.

A view of Shenzhen, which is among the Greater Bay Area cities. Co-chariman Lee George Lam says the bay area is ideal for satellite data application. Photo: Dickson Lee

Last month, the firm announced its entry into a preliminary agreement with the Abu Dhabi Ports Company to develop a massive aerospace technology and innovation centre in the United Arab Emirates.

The megacity covering 3 million square metres would integrate more than 1,000 commercial aerospace enterprises worldwide, and be able to build thousands of satellites every year, Lam said.

The development aims to have start-ups providing components, research labs, incubators and accelerators, with facilities for seminars and summits, intellectual property and legal industries, as well as a trading platform.

It will also offer development opportunities to start-ups in mainland China, to find funding, business opportunities and new markets in the Middle East.

Hong Kong was in a strategic position for Middle East investors thanks to its freedom of capital flows, low tax rate, proximity to the mainland and efficiency, Lam said.

Uspace has already launched 12 satellites under its Golden Bauhinia Constellation project, which aims to have a network of more than 100 above the bay area. It plans to produce and launch the project’s remaining satellites before 2026.

But experts warned that Hong Kong needed to do much more to take full advantage of opportunities in the NewSpace sector.

Dr Gregg Li, president of the Orion Astropreneur Space Academy, said the city had to wake up to the potential of the NewSpace industry in the next few years or risk missing out.

He said Hongkongers had to leave behind their traditional and limited understanding of the industry to tap into the private space sector’s potential.

“NewSpace came out too fast. Not too many people understand it because once they hear ‘space’, they think it’s too far away, we don’t understand it, and it’s related to the government so we cannot touch it,” he said.

The academy, a civilian-led accelerator in Hong Kong which supports early-stage and start-up businesses through investment and short-term mentoring, also educates youth and businesses about opportunities in space.

Pathways in the sky

Established in 2021, it organised Hong Kong’s first NewSpace forum, with 40 international guests gathering last October to discuss the development potential of the bay area.

“Our main vision is to see Hong Kong becoming a space hub by 2030. But Hong Kong is so far behind, it’s not even funny,” said Li, a corporate governance and technology adviser.

The city did not have a policy on investment in the sector, an authority in charge of it, or even a white paper identifying where the weaknesses were, he added.

“NewSpace is about e-commerce, 3D printing, building standards and pathways in the sky. Logistics involves space data, insurance, payment and telecommunication. Hong Kong needs to set a new standard for this, but we’re not there yet,” he said.

Li said existing industries with NewSpace potential were also isolated and could not see how they fitted into the bigger picture.

“A smart city can become much smarter if it understands NewSpace. Shenzhen has understood this much faster,” he said.

“In the last six months, we have seen more Chinese companies coming down [to Hong Kong] because they want to set up linkages.”

The mainland companies also saw the city’s ability to raise funds through the Hong Kong exchange.

Li said as an English-speaking financial hub, Hong Kong could be the glue integrating different industries, mediating conversations between countries and being a broker for investments for the NewSpace industry.

Professor Quentin Parker, director of the Laboratory for Space Research at the University of Hong Kong (HKU), said that while the city leader had laid out ambitious plans for a smart, green city in the Northern Metropolis in his policy address last October, he failed to mention how the NewSpace industry had an essential role.

“From monitoring traffic flow and pollution to urban density and green spaces, it can be done with a suite of relatively small and cheap satellites that take images of our city during the day and night with a decent resolution,” he said.

“With the data, we can see what our carbon footprint is, how many rooftops do not currently have solar panels, and how much light pollution there is. All that remote sensing can improve how a smart city functions and help with decision-making.”

The astrophysicist said he believed the bay area could be a nexus for NewSpace industries, given the 20 universities in the region, which provided opportunities for intellectual, academic and commercial exchanges.

“We have the best students in the city and coming from the mainland, with huge demand for our universities which are in the global top 100,” he said.

Parker said while the lab at HKU focused on research, the aviation and aeronautical department at Polytechnic University, specialising in engineering, had partnered with the China Aerospace Science and Technology Corporation and contributed to the country’s space missions.

“We are the talent incubators that generate the talent that these new industries need, here in the Greater Bay Area.”

Parker said that while Hong Kong companies could engage in hi-tech, small-scale manufacturing, testing and prototyping, they could be more cost-effective by tapping into the bay area’s land and manpower resources for most of the large-scale manufacturing.

“Here we have intellectual property laws, we are a tertiary education superpower, which attracts global talent,” he said.

“Because we’re one country but two systems, our system has more opportunities to link more confidently with external bodies internationally.”

Others are also eyeing opportunities in the skies.

Singapore launched its first locally produced commercial satellite in 2015, and its space sector comprises more than 50 companies and 1,800 employees. Over the past five years, more than 10 space and satellite-related start-ups have sprouted in the city state.

Vietnam established its space centre in 2011. It has launched multiple Earth observation satellites and collaborated with universities to address national challenges in areas such as agriculture, forestry and disaster management.

Indonesia is also planning to build a spaceport to launch rockets from its Papua province, becoming the only non-military spaceport in the Pacific located near the equator.

In 2018, Macau established a State Key Laboratory of Lunar and Planetary Sciences, approved by China’s Ministry of Science and Technology. It is the country’s first such state laboratory for astronomy and planetary sciences.

China’s first commercial aerospace industrial base, owned by Chinese commercial space launch enterprise CAS Space, opened in Guangzhou’s Nansha district last year with a sprawling 400,000 square metres set aside for it.

In early 2022, China published a white paper on developing the space industry, with President Xi Jinping spelling out its “eternal dream” of becoming a space power.

HKU’s Parker said that since then, China had made tremendous strides in space exploration in both the public and private sectors, including moon landings, the Chinese Manned Space Agency and various missions.

He added that the high-profile visit by the agency’s astronauts to Hong Kong last year helped to increase awareness of the sector and change public perceptions about the abstract nature of the space economy. It could also have helped influence parents to allow their children to pursue science, technology, engineering and mathematics courses.

Fine-tune talent policy

The city’s innovation chief Sun Dong announced last September that at least two candidates from Hong Kong had made it into the 20 finalists for payload specialists in China’s latest astronaut selection drive. Two positions were open to candidates from Hong Kong and Macau for the first time.

The role requires a strong background in science or engineering, and involves overseeing highly complex or classified on-board equipment and tasks such as taking astronautical measurements.

The candidates were among the 80 Hongkongers from government departments, the Hospital Authority, universities and other organisations shortlisted by the Hong Kong government following the announcement by China’s space agency.

That year, Chief Executive John Lee Ka-chiu highlighted the achievement in his policy address and said he looked forward to China’s continued support of Hong Kong’s participation in more national pioneering technology missions.

However, Lam of Uspace noted that aerospace experts were not among the job types in Hong Kong’s talent list, which allows workers to obtain a visa within four weeks under a fast track arrangement.

“They included artificial intelligence specialists and life sciences experts, which we also need in this sector, but we are missing people for the space industry. We hope they can update the list to include more industry-specific specialists,” he said.

“We must continue to fine-tune our talent policy to attract the best to Hong Kong while developing more local talent by working with universities to provide on-the-job training.”

Parker said the timing and environment were ripe for the Hong Kong government to develop space into a major new industry and take advantage of the “fantastic opportunities”. As a financial hub, the city could also play a major role.

“What we need is the right mood music and the right green lights and incentives and policy from the government in this area. I hope that by the next policy address, the Hong Kong government will have a policy shift or at least policy support,” he said.

“All these potential investors are sitting on the fence waiting to see what the government of Hong Kong is going to do. Is it going to give special support? Is it going to give incentives?

“All

these kinds of things create the right mood music for investors to have

confidence that it’s worthwhile investing in our city of Hong Kong

rather than Singapore or even Vietnam or other cities on the mainland.”

Source: SCMP

-

29

2025-05

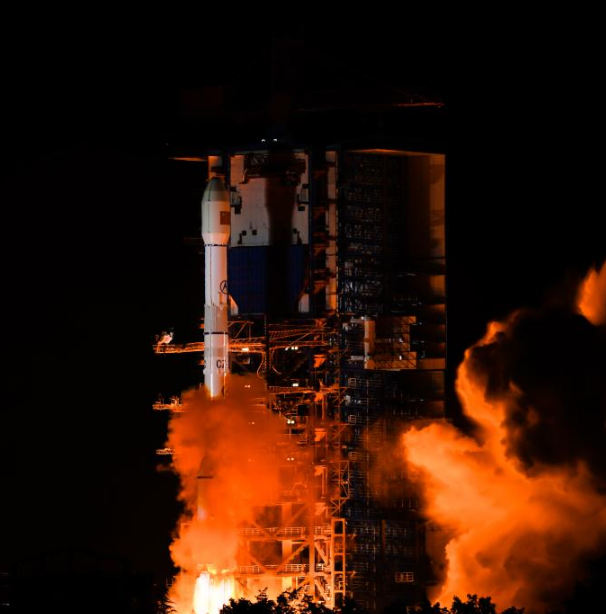

Tianwen-2 Mission Launched Successfully

At 1:31 AM today, China successfully launched the Tianwen-2 planetary exploration probe from the Xichang Satellite Launch Center using the Long March-3B Y110 carrier rocket.

-

13

2025-05

Communication Technology Experiment Satellite No. 19 Successfully Launched

At 2:09 on May 13, China successfully launched the Communication Technology Experiment Satellite No. 19 from the Xichang Satellite Launch Center using a Long March 3B carrier rocket. The satellite smoothly entered its predetermined orbit, and the launch mission was a complete success.

-

12

2025-05

Remote Sensing Satellite No. 40, Group 02, Successfully Launched

On May 11 at 21:27, China successfully launched the Remote Sensing Satellite No. 40, Group 02, from the Taiyuan Satellite Launch Center using a Long March 6A carrier rocket. The satellite entered its predetermined orbit smoothly, and the launch mission was a complete success.